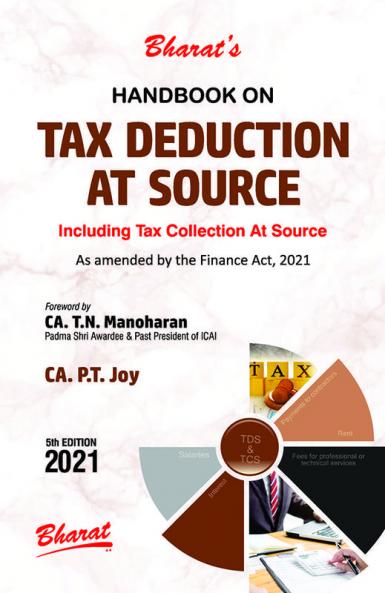

English

Paperback

₹446

₹595

25.04% OFF

(All inclusive*)

Delivery Options

Please enter pincode to check delivery time.

*COD & Shipping Charges may apply on certain items.

Review final details at checkout.

Looking to place a bulk order? SUBMIT DETAILS

About The Book

Description

Author

Chapter 1: Collection and Recovery of Tax — Introduction; Chapter 2: Section 192 — TDS on Salary; Chapter 3: Section 192A — Payment of accumulated balance to employees; Chapter 4: Section 193 — TDS from Interest on Securities; Chapter 5: Section 194 — TDS from Dividends; Chapter 6: Section 194A — TDS from Interest other than Interest on Securities; Chapter 7: Section 194B — TDS from Winnings from Lottery or Crossword Puzzle; Chapter 8: Section 194BB — TDS from Winnings from Horse Races; Chapter 9: Section 194C — TDS from Payments to Contractors; Chapter 10: Section 194D — TDS on Insurance Commission; Chapter 11: Section 194DA — TDS from Payment in Respect of Life Insurance Policy; Chapter 12: Section 194E — TDS from payments to Non-resident Sportsmen or Sports Associations; Chapter 13: Section 194EE — TDS from Payments in Respect of Deposits under National Savings Scheme etc.; Chapter 14: Section 194F — TDS from Payment on account of repurchase of units by Mutual Fund or Unit Trust of India; Chapter 15: Section 194G — TDS on Commission etc. on sale of lottery tickets; Chapter 16: Section 194H — TDS on Commission and Brokerage; Chapter 17: Section 194-I — TDS from Rent; Chapter 18: Section 194-IA — TDS on Payment on Transfer of certain Immovable Property (other than agricultural land); Chapter 19: Section 194-IB — TDS on Payment of rent by Certain Individuals or Hindu Undivided Family; Chapter 20: Section 194-IC — TDS on Payment under Specified Agreement; Chapter 21: Section 194J — TDS from Fees for Professional or Technical Services or Royalty or Non-Compete Fee; Chapter 22: Section 194K — TDS on Income in respect of Units; Chapter 23: Section 194LA — TDS on Payment of Compensation on Acquisition of certain Immovable Property (other than agricultural land); Chapter 24: Section 194LB — TDS from income by way of interest from Infrastructure Debt Fund; Chapter 25: Section 194LBA — TDS on Income from Units of Business Trusts;

Delivery Options

Please enter pincode to check delivery time.

*COD & Shipping Charges may apply on certain items.

Review final details at checkout.

Details

ISBN 13

9789390854769

Publication Date

-01-04-2021

Pages

-328

Weight

-491 grams

Dimensions

-158.75x241.3x17.45 mm