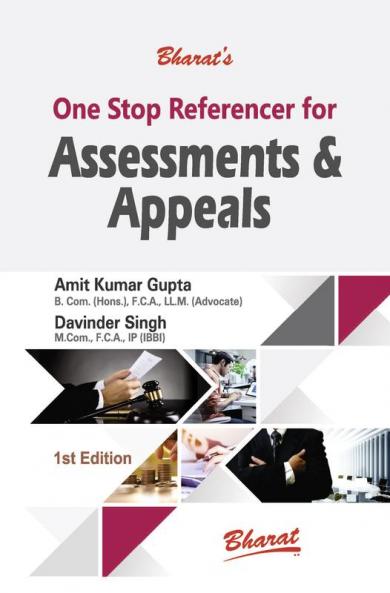

English

Paperback

₹1121

₹1495

25.02% OFF

(All inclusive*)

Delivery Options

Please enter pincode to check delivery time.

*COD & Shipping Charges may apply on certain items.

Review final details at checkout.

Looking to place a bulk order? SUBMIT DETAILS

About The Book

Description

Author

Chapter 1 Writ Petition in Income Tax ActChapter 2 Overview of Revenue and Capital ExpenditureChapter 3 Ignorance of Law is of no excuseChapter 4 Doctrine of Natural JusticeChapter 5 Waiver of InterestChapter 6 Taxation and Assessment of Dead PersonChapter 7 Section 263: Revision of orders prejudicial to revenueChapter 8 Substantial Question of LawChapter 9 Section 241A: Withholding of Refund in Certain CasesChapter 10 Deducted TDS not Deposited on Time You Could be ProsecutedChapter 11 Section 292B: Return of Income etc. not to be invalid on Certain GroundsChapter 12 Contempt of CourtChapter 13 Stay on DemandChapter 14 Right to Appeal to CourtsChapter 15 Faceless Assessment and AppealsChapter 16 Section 50C: A Step Forward in Curbing Black MoneyChapter 17 Appealable Orders Before Commissioner (Appeals)Chapter 18 Appeal Procedures to ITATChapter 19 Section 69: Unexplained investmentsChapter 20 Section 69A: Unexplained Money etc.Chapter 21 Section 69B: Amount of Investments etc. Not Fully Disclosed in Books of AccountChapter 22 Section 69C: Unexplained Expenditure etc.Chapter 23 Section 69D: Amount Borrowed or Repaid on HundiChapter 24 Section 115BBEChapter 25 Provisions of Search under Income Tax ActChapter 26 Admission and Retraction of Statement under SearchChapter 27 Section 153A: Assessment in Case of Search and Requisition/Section 153C: Assessment of Income of any other personChapter 28 Section 153B: Time Limit for Completion of Assessment under section 153AChapter 29 Section 153D: Prior Approval Necessary for Assessment in Cases of Search or RequisitionChapter 30 Case Laws on Section 153AChapter 31 Section 147/148: Income Escaping Assessment an Effective Tool to Curb Black MoneyChapter 32 New Procedure of Income Tax AssessmentsChapter 33 Section 271AAB: Penalty Where Search has been InitiatedChapter 34 Section 271DChapter 35 Section 271E: Penalty Provisions for Failure to Comply with the Provisions of Section 269TChapter 36 Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act 2015Chapter 37 Direct Tax Vivad Se Vishwas Act 2020Chapter 38 “Charitable Objects” under Income Tax ActChapter 39 Terms used in Case laws and their meanings

Delivery Options

Please enter pincode to check delivery time.

*COD & Shipping Charges may apply on certain items.

Review final details at checkout.

Details

ISBN 13

9789390854790

Publication Date

-22-11-2021

Pages

-840

Weight

-954 grams

Dimensions

-158.75x241.3x33 mm